Franchisee Turnover

By Eric H. Karp, Esq., General Counsel To NCASEF

The United States Federal Trade Commission Franchise Rule requires all franchise companies to annually disclose not only the number of franchised locations they have, but a variety of other data regarding increases or decreases in the number of franchised locations and the reasons for those changes.

One of the reasons for this required disclosure is to allow a prospective franchisee to gauge whether the franchisee community is growing or shrinking and in either case, attempt to understand why.

One way of summarizing this data is to estimate the extent to which the franchised locations in the system are turning over, that is to say, changing hands or status, in and if so, how. In my work with the National Coalition and other franchisee associations, I have developed my own definition of turnover, which consists of the following:

(Terminations + Non-renewals + Reacquisitions by the Franchisor + Abandonments of locations) / (total franchised locations at the start of the year + total franchised locations at the end of the year/2).

All of the information necessary to make these calculations can be found in Item 20 of each Franchise Disclosure Document issued by 7-Eleven, Inc. One of our roles as General Counsel is to be a repository of important documents in the system. As such, we maintain a library of Franchise Disclosure Documents going back nearly 20 years.

Transfers are sales of franchised locations from one franchisee to another franchisee. These transactions can sometimes be the result of distress or bad news, such as the death or incapacity of a franchisee, or good news in the sense that a franchisee has reached the stage where he or she wants to retire or engage in other activities. The number of transfers in this system also includes those situations where 7-Eleven gives a franchisee who has received a termination notice a period of time to attempt to sell the location rather than having it terminated. (Termination notices can often be avoided by curing a default and staying in compliance with the franchise agreement and its operating standards.) Nevertheless, when such a sale is concluded, it is treated as a transfer rather than as a termination. This is one of the reasons, as you will see, that the number of terminations in the 7-Eleven system has historically been low. On the other hand, over the past five years there have been nearly 1,200 transfers. It is also the reason that we don’t count this statistic in the turnover rates, because we cannot determine how many of the transfers were good news and how many of the transfers were bad news events.

Before we take a look at turnover rate in the 7-Eleven system, let’s define our terms:

- Terminations. This is an event where the franchisor chooses to terminate the franchise agreement and require the franchisee to leave the business without compensation. As stated, these events are typically quite rare in the system. In fact, over the last 10 years there have been only 26 terminations.

- Non-renewals. If the franchisee completes the term of the franchise agreement, it expires by its own terms and the franchisee elects not to renew and sign a new franchise agreement and thus exit the system, this is treated as a non-renewal. This is the rarest of events in the 7-Eleven System, having occurred only twice in the last 17 years.

- Reacquisition. If the franchisor chooses to purchase the location from the franchisee, this is treated as a reacquisition. It may result from a simple business decision by 7-Eleven or in some instances a pathway to the resolution of a dispute between franchisee and franchisor. Over the past 10 years more than 1,700 locations have been bought back by 7-Eleven.

- Abandonments. If the franchisee simply walks away from the location, including those instances where the franchisees exercise her or his right to terminate the franchise agreement, this is treated as a catch-all for locations where the franchisee is no longer the operator, but it is not the result of a termination, a non-renewal, or a reacquisition. Over the past 10 years, these abandonments have averaged about 75 locations per year.

- Total Franchised Locations. This data can be found in Chart 1 of item 20 of each FDD which discloses the total number of franchised stores in the system at the start and the end of each of the last three complete calendar years. For the purposes of this disclosure and the calculation of the turnover rate, we count only events and locations within the 50 states of the United States. Our analysis started with 2006, when there were 3,525 franchised locations at the start of the year, to 2022 when there were 7,280 such locations at the end of that year, meaning that over that period, the number of franchised locations had doubled.

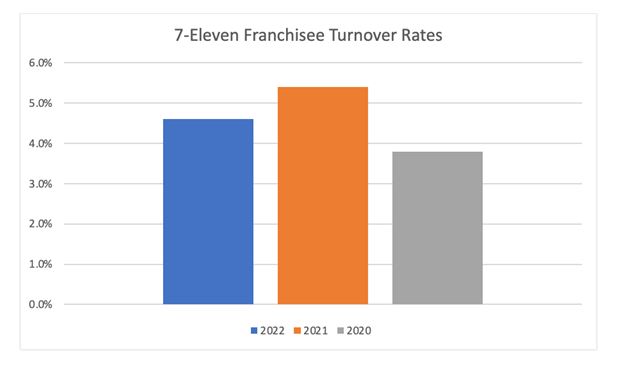

We analyzed turnover rates in the 7-Eleven system going back 17 years. That detailed study will be included in the presentation that I will make at this year’s Convention and Trade Show in Las Vegas. But for the purpose of this article, I would like to look at just the turnover rates over the last three years in the 7-Eleven system, ending with 2022, summarized on the following chart, averaging 4.5 percent.

For perspective, the average turnover rate for the three years ended 2012 was 1.9 percent.

It occurs to us that many franchisees will not find these numbers surprising given the material number of franchised locations that have changed hands in recent years. The reasons for these events are myriad and complex and we will continue to investigate and bring you our findings.

It occurs to us that many franchisees will not find these numbers surprising given the material number of franchised locations that have changed hands in recent years. The reasons for these events are myriad and complex and we will continue to investigate and bring you our findings.

Our continuing role is to research and report on information that we believe will be of interest to every franchisee in the system. We hope that this information is useful.